Your Tax Expert in Western Switzerland

With TaxFlow, la solution n°1 en Suisse romande, nous réalisons votre déclaration d’impôts en ligne simplement, rapidement et sans stress.

- Quick & easy

- 100% online

- With experts

Powered by:

Join the hundreds of customers who place trust us every year

Trustindex vérifie que la source originale de l'avis est Google. Really happy with the expertise of the advisor. Jose is a very good communicator and a people person. Explained the process well, did the filling as desired. Thus, we highly recommend it.Trustindex vérifie que la source originale de l'avis est Google. EVERYTHING WENT WELLTrustindex vérifie que la source originale de l'avis est Google. Very satisfied with the service. Professional and friendly. The documents were well managed and the service was made with very good knowledge of the field.Trustindex vérifie que la source originale de l'avis est Google. Excellent Service! Very knowledgeable English speaking accountants on the details of Geneva taxation. They helped me with my personal annual tax declaration. Highly recommended.Trustindex vérifie que la source originale de l'avis est Google. Merci à Monsieur Flores pour sa prise en charge rapide. Ma déclaration d’impôts a pu être faite à temps. Très professionnel.Trustindex vérifie que la source originale de l'avis est Google. J’ai fait appel à TaxFlow pour ma déclaration fiscale à Genève. Je suis très satisfaite du service. Ils sont aux petits soins et c’est très apprécié.Trustindex vérifie que la source originale de l'avis est Google. Très satisfait des services pour ma déclaration d'impôts. Professionnalisme, conseils avisés et une approche personnalisée qui m'ont permis d'optimiser ma situation fiscale. Un grand merci à l'équipe !Trustindex vérifie que la source originale de l'avis est Google. Merci beaucoup pour votre gentillesse jose,votre explication et très clair merciÉvaluation Google : 5.0 sur 5, Basée sur 24 avis

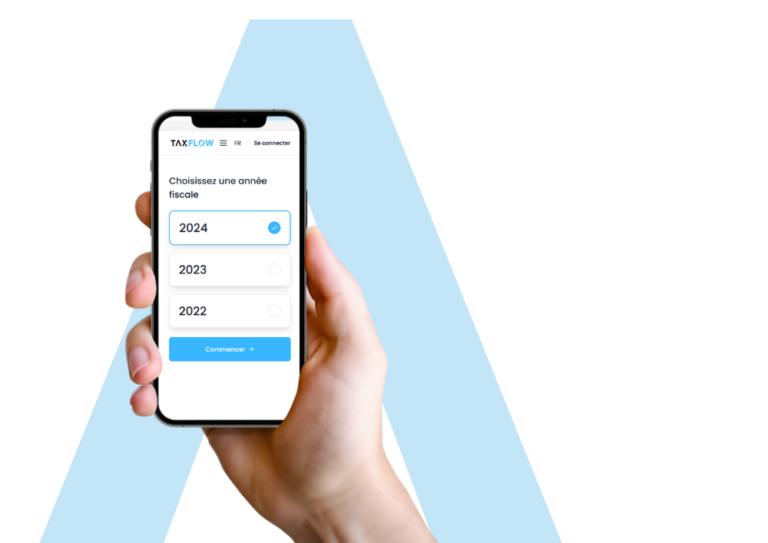

No more hassles, our intuitive application guides you step by step to ensure that your tax return is accurate, complete, and beneficial. With TaxFlow, manage your taxes with ease, wherever you are in French-speaking Switzerland!

Discover TaxFlow

Taxflow simplifies the tax return process, allowing you to manage your tax documents without having to travel.

- Our algorithm determines which documents to file

- Reduce the time you spend on your tax return

- Be in order at all times

- Customize your package to suit your needs

Nous vérifions et contrôlons toutes les déductions auxquelles vous avez droit afin d’optimiser votre situation.

Discover our Rates

Our transparent rates are tailored to your situation and needs.

TaxFlow is the easiest way to manage your taxes in Switzerland. Our intuitive application guides you through every step, optimizing your deductions and simplifying your tax affairs.

Complete our online form

Our intuitive, personalized form guides you through every step of filing your tax return.

Submit your documents

Drop off your documents in 2 clicks in your dedicated space. You deposit only the documents we need.

An expert on your file

A Swiss-trained expert prepares your tax return, in accordance with the highest standards and rules of your canton.

Analysis of deductions

We analyze all the deductions to which you are entitled. You pay only what the tax owes.

Secure application

Our 100% Swiss-made web application uses best practices to guarantee the security of your data.

Frequently Asked Questions

Discover our answers to frequently asked questions about filing your tax return in French-speaking Switzerland.

With TaxFlow, everything is simplified in three steps:

- Complete our online form Answer a few questions about your tax situation and receive your prize instantly.

- Submit your documents Answer additional questions about your situation and submit your documents.

- Done! Once you've submitted your documents, we'll take care of the rest and send you a confirmation. Then all you have to do is send the declaration to the AFC, and you're done!

De délai de dépôt dépendra du forfait choisi. Nous pouvons effectuer des déclarations express en 10 jours avec le forfait premium.

Thanks to our intelligent algorithm, we automatically identify the documents you need and guide you through the process. This saves you time by simplifying and optimizing each step of the declaration.

Of course. TaxFlow allows you to choose a package tailored to your needs. Whether your tax situation is simple or complex, we have a solution for you.

Yes, the security of your data is our priority. TaxFlow uses advanced security protocols to ensure that all your personal and tax information remains protected.

TaxFlow has been designed for individuals and families in French-speaking Switzerland who wish to simplify their tax declaration. Whether you are an employee, expatriate, self-employed or homeowner, our service is adapted to your situation.

Yes, TaxFlow is available throughout French-speaking Switzerland. No matter where you live, you can use our application to manage your taxes quickly and easily.

It's easy! All you have to do is fill out our form online, and we'll take care of the rest. You'll be guided through the entire process.

Join the hundreds of customers who place trust us every year

TaxFlow

Logiciel de l'administration cantonale

Fiduciaire traditionnelle

Every week, TaxFlow brings you articles on tax, VAT and legal issues.